Flexible, long-term growth investments

Next section

About Gryphion

Formed in 2018, Gryphion is a family investment platform investing in multiple asset classes, predominantly in Western Europe.

Defined by flexibility and not by exit-pressures, Gryphion primarily makes direct investments or large-scale co-investments in businesses with high growth potential, providing management teams, founders and entrepreneurs with long-term capital, industry-leading private equity experience and operational expertise. Gryphion also invests in special situations and holds an extensive portfolio of liquid assets.

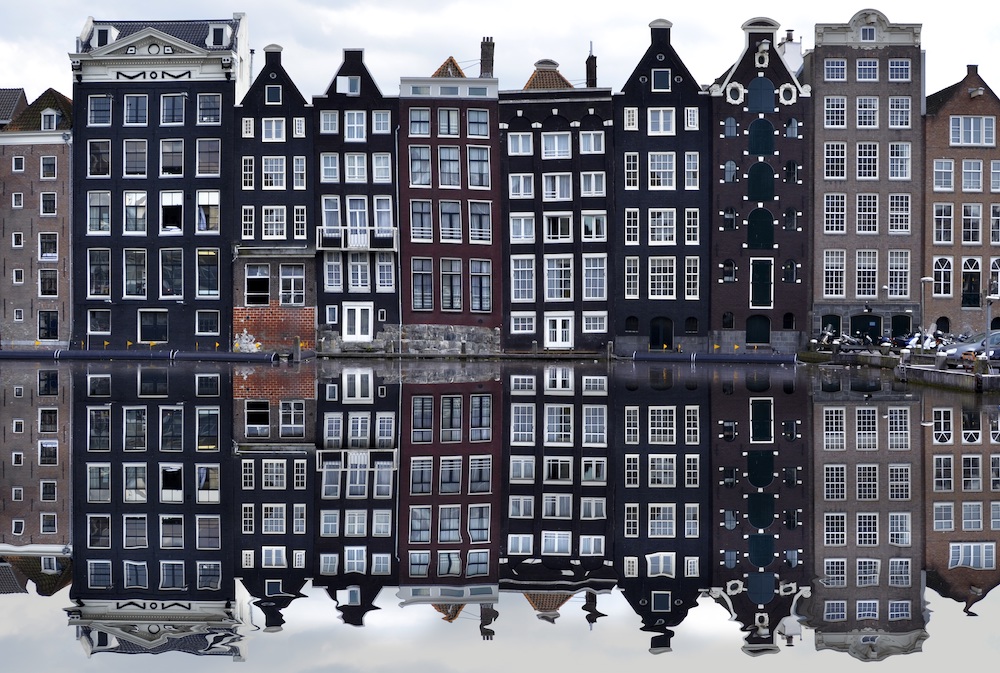

Operating out of Amsterdam, with offices in London and Antwerp, Gryphion invests capital on behalf of Rob Thielen, Founder and Chairman of Waterland Private Equity Investments, one of the world’s best performing private equity groups, and other select high net worth individuals and family offices.

Our Team

Robert Thielen

Founder and Chairman

Robert Thielen is the Founder and Chairman of Gryphion, which he founded in 2018. He also serves as Chairman of the Supervisory Board and partner of Waterland Private Equity Investments. After founding Waterland in 1999, Rob developed the firm into one of the best performing private equity groups in the world, currently active in twelve core countries in Europe, with acquisitions in dozens of countries across all continents. Waterland has invested in more than 1000 companies across its four investment themes. It currently manages € 20 billion in equity.

Rob graduated in tax law at the University of San Diego in California, USA and obtained a degree in international tax law at the Rijksuniversiteit Leiden, the Netherlands.

William Ford

Chief Investment Officer

William Ford is the Chief Investment Officer at Gryphion and is responsible for the firm’s investment strategy. William was previously a Principal at Waterland Private Equity Investments, where he was employed for more than 13 years and involved in a range of different portfolio companies and investment opportunities and responsible for the coordination of debt financing across the group. Before joining Waterland, William worked at Dutch investment bank NIBC.

William holds Masters degrees in Business Administration and European Law from Groningen University, an MPhil in Finance from Judge Business School, University of Cambridge, and is a CFA Charterholder.

Ruth Baert

Chief Financial Officer

Ruth is Chief Financial Officer at Gryphion. Ruth was previously Legal Counsel of Waterland Private Equity Investments, working directly with Rob Thielen. Prior to joining Waterland in 2012, Ruth worked at VGD, where she held several senior positions across a number of different departments, including audit and Truncus, the firm’s family office arm.

Ruth holds a Master’s degree in Law from the Catholic University of Leuven, after which she also obtained a secondary degree in additional studies, administration and business management from the Catholic University of Louvain-la-Neuve, Belgium.

Christel Mooren

Business Administrator

Christel is an Accountant at Gryphion. Prior to joining the firm, Christel spent over five years at Waterland Private Equity Investments as a Business Administrator providing financial support to the firm. Previously, Christel worked for several years as head of Terminal Customer Service at Euroports, one of the largest port operators in Europe, with concessions in more than 20 European locations.

Christel holds a Master’s degree in Commercial and Consular Sciences from VLEKHO.

Strategy

Gryphion is unconstrained by narrowly-defined investment strategies and takes a long-term approach to its investments, deploying capital flexibly in support of growth.

Gryphion identifies proprietary investment opportunities in businesses with high-growth potential and exceptional management teams and supports their growth, providing management teams, founders and entrepreneurs with truly long-term capital, industry-leading private equity experience and operational expertise.

As well as making direct investments, Gryphion also invests in special situations and holds an extensive portfolio of liquid assets. Gryphion focuses on transactions between €20m and €200m enterprise value or more.

Portfolio Companies

Cinesite (since 2019)

Cinesite is one of the world’s leading independent digital entertainment studios, producing award-winning visual effects and feature animation. Customers are movie and episodic content studios and broadcast and streaming media platforms. Cinesite is active globally with office locations in the UK, Canada, Germany, Macedonia and India.

See the Cinesite website for more information.

Emsere (since 2019)

Emsere is a one-stop shop for medical equipment rental and support services for clinical trials. It supports its customers to decrease their total cost of ownership of medical equipment and takes care of all related logistical and support activities. Emsere is active globally (>10.000 medical trial sites in >100 countries) with offices in the Netherlands, the United States and Singapore. See the Emsere website for more information.

Welbeck Health Partners (since 2024)

Welbeck Health Partners (WHP) is a healthcare clinic focused on private ambulatory healthcare services with 13 different specialist groups and >250 healthcare consultants. WHP was founded by a group of leading healthcare specialists from the UK and US in 2016 and opened its flagship center in London in 2017 at One Welbeck Street. WHP is currently in the process of adding two centers in Oxford and Cambridge; both are expected to open in 2025. See the WHP website for more information.

LeefEnergieBewust (since 2024)

LeefEnergieBewust (LEB) helps households, companies and public organizations to make their residential, commercial and public buildings more sustainable

LEB installs and maintains insulation, PV systems, batteries, heat pumps and EV chargers throughout the Netherlands; in addition, it provides energy certification and building sustainability advisory services

The company operates under the labels Rouwenhorst Isolatie, Bestisol, Smit Isolatie, Helder Zon and 12MNDN

Please see the LEB website for more information

Brisker (since 2025)

Brisker is a market-leading HR services provider focusing on employer of record and agency of record services for the flexible labor market in the Netherlands and Belgium.

With its proprietary IT system, Brisker unburdens temporary employment firms, freelancers, small and mid-sized enterprises and large corporates by taking over and managing all administrative processes and risks related to flexible labor.

Under its brands Pay for People and Tentoo, Brisker processes more than 20k unique employee records annually.

See the Brisker website for more information.

Moliera2 (since 2022)

Moliera2 is a Polish multi-brand luxury e-fashion platform with a strong online presence and several (offline) boutiques. The company offers 450 luxury and premium brands, of which 100 are exclusive, on its e-commerce platform and in its 8 luxury boutiques throughout Poland

Moliera2 is based in Poland and sells its products throughout Europe; the company is publicly listed on the Warsaw stock exchange. See the Moliera website for more information.

Marina Development Corporation

(since 2022)

Marina Development Corporation (MDC) focuses on the regeneration of existing urban waterfronts in the Mediterranean into high-end lifestyle destinations for both local and international demand. MDC is currently developing >200k m2 of residential and commercial areas in two key locations in Italy (i.e., Marina di Ventimiglia and Marina di Pisa)

The development projects include high-end residences, hotels, restaurants, marinas and public venues and parks. See the MDC website for more information.

Divestments (since 2018)

Gryphion divested Skeye BV, an unmanned aerial vehicle (UAV) provider delivering high-end aerial imagery services to clients in the Netherlands, which was acquired in November 2018 by Terra Drone, Japan’s largest UAV firm. Also divested is MainUnited, a claim management company focusing on in-kind repair services in case of damage to houses and other properties. Other divestments include Lafrontiere, a Paris-based provider of talent to the fashion industry and a hybrid financing structure provided to a Belgian leisure company.

CONTACT US

T. +31 20 2442 996

Gryphion, Barbara Strozzilaan 201, 1083 HN, Amsterdam, The Netherlands